Posting Date: November 12, 2025

Deadline: December 12, 2025 at 3:00 p.m.

Check whether your current residence is located within an eligible census tract for application prioritization.

| Central Falls | 44007010900, 44007010800 44007011100, 44007011000 |

| Pawtucket | 44007016000,44007015300, 44007015100, 44007015200, 44007015500, 44007016600, 44007016700, 44007017000, 44007017100, 44007016100, 44007016400 |

| Newport | 44005040500, 44005041100 |

| East Providence | 4400701010100, 44007010501 |

Type in your address below to learn if you are in the targeted area. (Include street #, street name, city, RI).

Check whether your current residence is located within an eligible census tract.

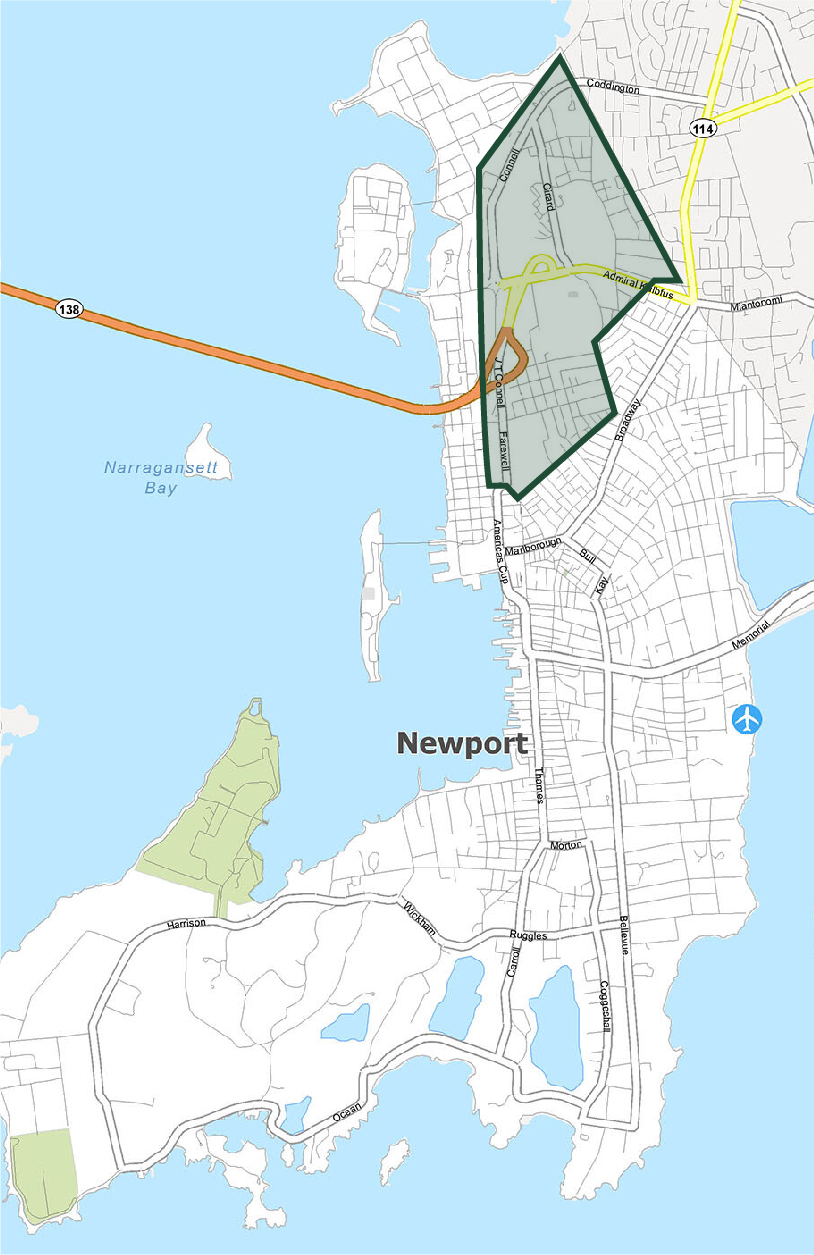

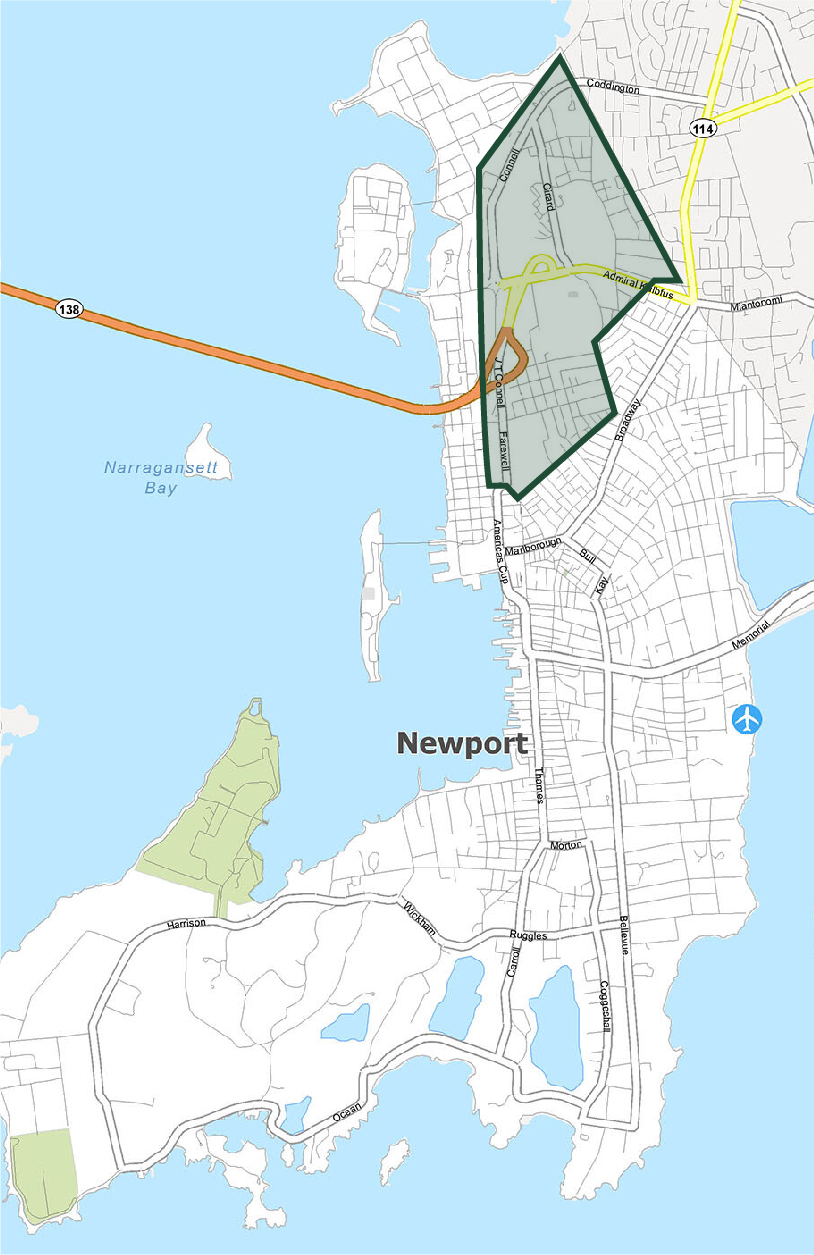

Only residents of census tract 405 are eligible for the FirstGenHomeRI pilot program.

The map on the left shows the approximated eligible region.

Unsure if your address is part of the eligible region?

Type in your address below to find out (Include street #, street name, Newport, RI).

Verifique si su residencia actual se encuentra dentro de un distrito censal elegible.

Solo los residentes del distrito censal 405 son elegibles para el programa piloto FirstGenHomeRI.

El mapa de la izquierda muestra la región elegible aproximada.

¿No está seguro si su dirección es parte de la región elegible?

Escriba su dirección a continuación para averiguarlo (incluya el número de calle, el nombre de la calle, Newport, RI).

RIHousing administers the Thresholds Program on behalf of the Rhode Island Department of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH).

The Thresholds Program includes capital development funding and pre-development loans to increase the supply of housing for people with serious and persistent mental illness and developmental disabilities.

Projects that integrate people with serious and persistent mental illness and developmental disabilities with the rest of the public are preferred over projects that segregate these populations in single or adjacent buildings. Housing exclusively for people with serious and persistent mental illness or developmental disabilities must either be supervised or provide access to on-site mental health services during the day.

Michael DiChiaro

401-457-1274

mdichiaro@rihousing.com

Primary program for financing the construction and rehabilitation of affordable apartments. The program offers financial incentives to preserve, develop, construct, produce or rehabilitate housing developments and combines many of our financing vehicles into ‘one-stop shopping’ for financing affordable homes. The apartments must be affordable to households earning no more than 60 percent of HUD’s median family income.

Financing to purchase or refinance existing Section 8 apartments in exchange for extending the affordability restrictions beyond the term of the original HAP contract. This program also can give Section 8 owners access to a project’s residual reserves.

LIHTCs are the principal federal program for the construction and rehabilitation of affordable apartments. Tax credits are a dollar-for-dollar credit against federal tax liability. RIHousing allocates tax credits to developers of affordable apartments. Developers then sell the credits to investors, generally for-profit corporations and investment funds, generating the equity necessary to complete their projects.

Funding to cover improvements to older homes that may have lead and meet certain eligibility requirements.

Tax-exempt and taxable first-mortgage financing available for construction and permanent financing for mixed-income projects at terms of up to 40 years. In general, developments must meet one of the following criteria:

– 20% of the units are occupied by households at 50% area median income (AMI);

– 40% of the units are occupied by households at 60% AMI; or

– At least 40% of the units are occupied by households with income averaging no more than 60% of AMI and no units are occupied by households with incomes greater than 80% AMI.

Financing with fixed or floating rates for land development or rehabilitation of existing buildings for rental or homeownership. For rental development transactions, we also offer a conversion option, which includes long-term, fixed-rate permanent financing. Using a variety of options, including taxable or tax exempt bond financing, conduit bond financing or lender participants, we can customize a financial structure to meet the goals of your development.

Funding to stabilize neighborhoods and communities by strategically targeting foreclosed and/or blighted residential and commercial properties and vacant lots in need of redevelopment. Approximately $10 million in funding has been awarded. Read the press release to learn more

Lauren Farley

401-429-1412

lfarley@rihousing.com