Because “life happens”

The HomeSecure grant acts as a ‘safety net’ when you need it.

And what if you don’t need it?

This might be the best part.

Grant funds that remain at the end of three years will be applied to the principal balance of your mortgage.

This means you’ll be able to have added equity in your home.

Next Steps

If you are here, it means you’ve taken the first step: working with a community partner to complete your financial education course. Haven’t completed a course yet? Click here to see a complete listing of community partners offering the classes >

Next, you’ll need to get pre-approved for a mortgage loan through RIHousing’s Loan Center. In this step, you’ll provide documentation of your income and assets. The Loan Center will review your credit and verify your employment history. Staff will review this information to determine whether you have the financial resources to purchase a home and if so, how much money you could borrow and how much you could pay per month.

You’ll need the following documents for pre-approval:

- Last 2 Paystubs;

- Recent Bank Statements;

- Last two years’ W-2s;

- Copy of your Certificate of Completion for the Financial Literacy course.

HomeSecure Grant Requirements

Grant Recipients Must:

-

Complete a Financial Literacy Course offered by a designated RIHousing Community Partner prior to applying for the first mortgage loan;

-

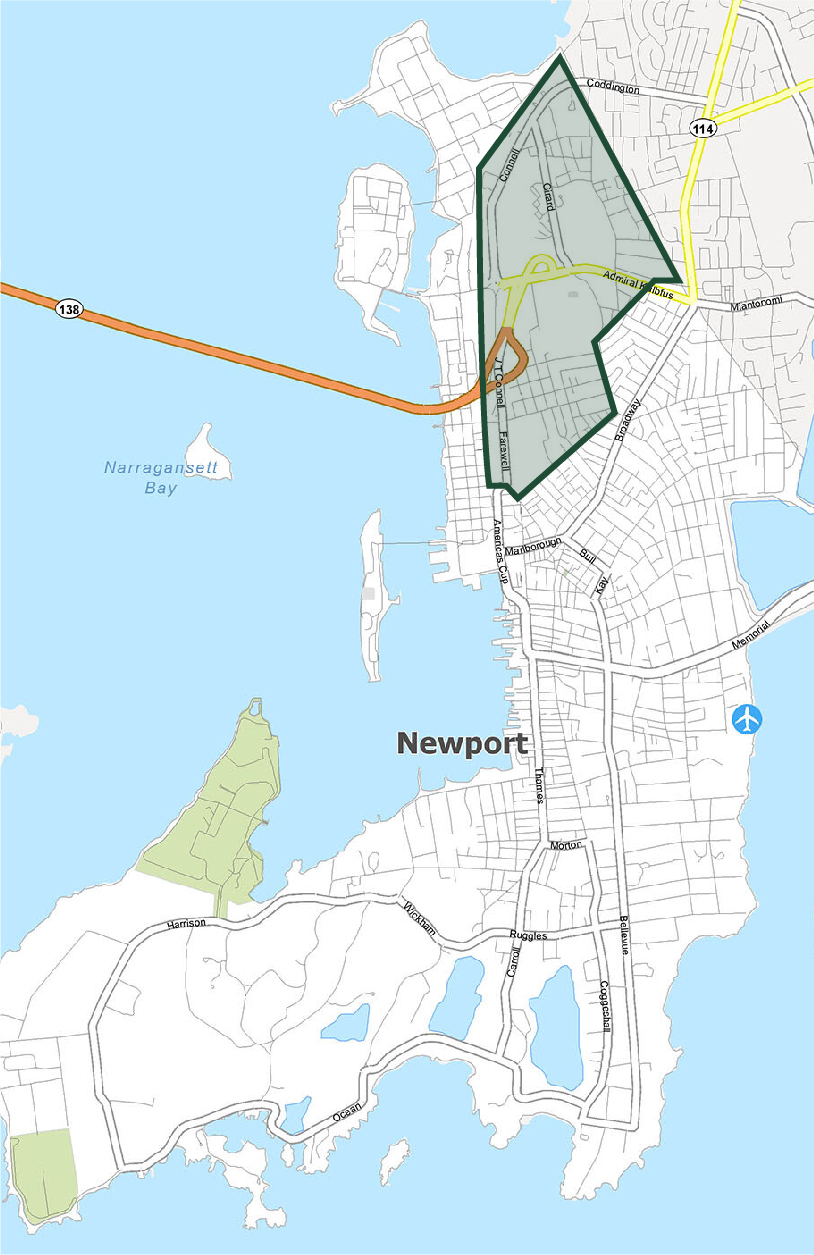

Be a first-time homebuyer purchasing a home in Rhode Island;

-

Complete RIHousing’s Online Post-Purchase Financial Education prior to first payment due date for first mortgage loan**; and

-

Enroll in RIHousing’s automatic mortgage debit payment program.

- Unexpected illness or medical-related expenses

- Unexpected repairs (e.g a home repair or an auto repair)

- Unexpected increase in energy costs

Working with local financial literacy course providers, RIHousing offers this exciting, limited-time grant through its Loan Center.

* Click here for loan and income limits.

**Completion of the Financial Education course is not a guarantee of eligibility for the HomeSecure Grant Program. Course completion is one aspect of eligibility. Applicants will also need to meet RIHousing mortgage guidelines and program eligibility requirements.

Are you ready for Homeownership?

620

Improve your credit score.

We recommend you start by understanding and reviewing your full credit report by requesting a free report at annualcreditreport.com.

Check for discrepancies or incorrect information and verify that all of the accounts listed on the report are yours.

Questions?

Reach out to our Loan Center at 401-450-1349

About the HomeSecure Grant

RIHousing’s HomeSecure Grant is a stand-alone grant offered in conjunction with a RIHousing first mortgage. The intent of the grant is to encourage homeownership for first-time homebuyers and ensure that Rhode Islanders have access to credit and a stable and affordable primary residence. The grant provides an emergency fund reserve in the amount of 3 months of mortgage payments (Principal, Interest, Taxes and Insurance) for a period of 3 years from the closing on the first mortgage loan. The purpose of the grant program is to provide emergency funds within the first 3 years of a mortgage loan to ensure homeowners have adequate money available to make their mortgage payments and avoid default.